Fast Invest makes P2P investing easy

I’ve written about Fast Invest in my Finnish personal finance blog twice already but since I know it’s still somewhat unknown player and there isn’t that many reviews, I though I’d introduce it to my English speaking friends and share share my experience on the platform. I first discovered Fast Invest in may and have been investor ever since. I really like what they are trying to achieve and there’s also ICO to help them to the next stage but this post won’t cover that, I’ll purely concentrate on the Peer-to-Peer lending side.

Simple with awesome guarantee

Fast Invest was established in 2015 by it’s CEO Simona Vaitkune. They want to make investing safe and easy so that anyone can take advantage of compound interest and grow their wealth. There’s very low threshold to beginning investing on Fast Invest as you can start with just 1€. Most P2P marketplaces in Europe now provide 100% buyback guarantee in case the lender defaults on their loan. Well Fast Invest takes that to a new level by guaranteeing every payment to the investor. If the loan payment is late more than 3 days they will cover the payment to the investor well actually it’s the loan originators who actually provide that guarantee.

No secondary marketplace but still liquid

Another thing Fast Invest is doing differently than most platforms is that there is no secondary market to sell your loans if you need to get your money back sooner than the loan has been fully paid. You’d think that’s bad but instead they offer to buy back the loan at anytime within one business day. There’s a catch though you’ll lose interest paid on that loan and only get back the principal you invested. That means ALL the interest paid on that loan is deducted from your account if you sell back the loan. That is the price you pay for liquidity. Personally I like the penalty rate Envestio uses when they buy back a loan.

Loan origination

Fast Invest also uses the same kind of loan originator model that Mintos, PeerBerry and many other European P2P lending marketplaces use with the exception that they don’t actually tell you what companies they use as their loan originators. I can understand why they do that for less sophisticated investors that is just noise and makes things more complicated but someone like me wants to know exactly what kind of risks there are. Not knowing who the loan originators are and what is their track record in profitability and risk management is a big thing. That is the single thing that for me increases the risk profile of Fast Invest loans but still it’s part of my overall P2P investment portfolio.

My Experiences

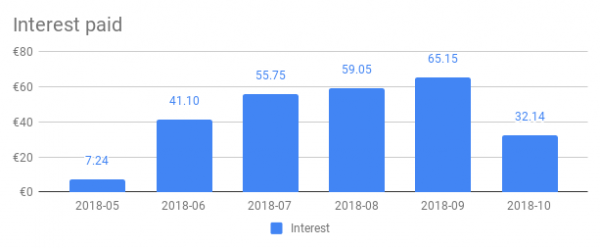

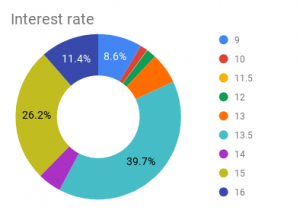

Like I mentioned in the beginning I’ve been investing on the platforms since early May so that adds up to 5 months already and so far it has been working smoothly. The customer service has been quite responsive via email when I’ve had questions. While loans with higher interest rates have been in short supply with Mintos and PeerBerry, Fast Invest has consistently had loans with 15% interest rate in Euro denominated loans and 16% with Polish Zloty. The auto invest does all the heavy lifting and for me it has been on autopilot since day one. I just check it maybe few times a month. All in all it has lived up to it’s promise.

Currently I have my money diversified in 680 loans which actually is unnecessary because of all the guarantees of payment but I still like to play it safe. The weighted average interest rate of my loans is 14,28% and term is 10 months. So far none of the loans have been late at the time of I have created my monthly report. My internal rate of return has been 13,11% annualized and I’ve received 260,43€ interest and have 105€ pending bonus.

Okay let’s cover now the bad stuff so this won’t be all braise. Fast Invest really needs better reporting, what they’ve got is just barely enough to report your earnings on your tax return in Finland and gladly all we need to report is how much interest we earned. I however like to get more information like all the numbers I’ve mentioned so far as well as monthly statement like you get from your bank. For myself I’ve solved it by using my superpower of writing code and I’ve coded a script to retrieve all that information as csv I can load into my google sheet that creates all my reports for all the P2P platforms I invest in.

Marketplace

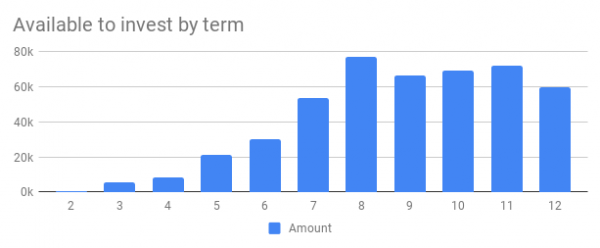

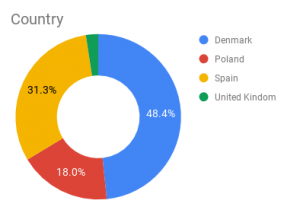

I used my script to capture a snapshot of all the loans available on Fast Invest on Oct 14th around 2pm.

Number of loans available: 52

Weighted average loan term: 8,9mo

Weighted average interest rate: 13,70%

Amount of Euro denominated loans available to invest: 383 417,16€

Amount of Zloty denominated loans available to invest: 358 928,14 PLN

All the amounts are converted to Euros and used to weigh based on how much is available to invest. Only Polish Zloty loans have 16% interest rate available.

Start investing in Fast Invest today!

Please note that this post contains affiliate links. I get a small commission when you sign up but it doesn’t cost you a thing.